The Arrival of Artificial General Intelligence in Insurance is Imminent. Is Your Head in the Sand?

Seeing the progress and the latest demos of Google Gemini even with some “demo” hacking, in my opinion, means we are about to have the Artificial General Intelligence come into Insurance and make the largest change in history to the 2nd largest financial market in the world.

This scenario will crown massive winners and losers in the next 12-24 months. Are you ready, or are you burying your head in the sand or if you need help, we can bootstrap your GenAI Center of Excellence plans. On to the good stuff.

I have architected 200+ insurance transformations in two decades and as your humble ‘Industry Inciter,’ I am compelled to help everyone by forecasting the exact impact of AGI-I (Artificial General Intelligence for Insurance) all the way to the business process level!

Because if there is one constant you can count on, its change and if there are two things you can count on… nothing compares to the seismic shift that AGI-I promises…

What does that mean for the $8 Trillion of Insurance Premiums?

AGI-I as I call it, isn’t just about automating processes; it’s about reimagining them. It’s about harnessing the power of AI to make more informed decisions, understand risks better, and ultimately, provide unprecedented value to customers. In a lot of ways I feel like IF WE ARE SMART, we can truly live up to the promise of Insurance and reduce and eliminate losses for great financial success. IF WE ARE SLOW… AGI-I has the potential to reshape the economics of the industry, bringing both massive challenges and opportunities like never before seen. Imagine a world where Acord forms and dual entry are COMPLETLY GONE. That by itself would be a million dollar change for 1000+ companies or more. And AGI is going to eat these uses cases up for breakfast.

So what do we do now?

Why we do what all good robot revolutions do, we use AI to fight the coming AI overlords! I present to you a multi-part report on each area of the Insurance Product Life Cycle and Customer Journey broken down step by step and then we are going to do full AI Impact Assessment to Each to see the damage. #UsingAI2FightAI

Eating the Insurance Elephant

How do you eat an elephant? One bite at a time. So, let’s break down this ‘messy’ industry into the following 9 areas and tackle each one step by step…

- Ideation Phase: This is the initial stage where new insurance products are conceptualized based on market research, risk assessment, and regulatory feasibility.

- Development & Approval: In this phase, the conceptualized insurance products are developed, integrating various aspects like actuarial data, regulatory compliance, and system integrations.

- Go-to-Market Preparation: This stage involves preparing for the market launch of the insurance product, including marketing strategy development, agent training, and customer support preparation.

- Product Launch: The actual introduction of the insurance product to the market, involving marketing campaigns, public relations, and initial sales efforts.

- Policy Issuance and Servicing: This process includes the issuance of insurance policies to customers and the ongoing servicing of these policies.

- Claims Processing: In this phase, insurance claims are received, processed, and settled, involving verification of policy coverage and assessment of claims.

- Feedback and Improvement: This stage involves collecting feedback from customers and other stakeholders, and using this feedback to improve insurance products and services.

- Renewal or Termination: This process deals with the renewal of existing policies or their termination, including customer communication and processing of renewals or cancellations.

- Reinsurance & Special Processing: This final stage includes managing reinsurance processes and handling special cases or exceptions in policy processing and claims.

We are going to go though each of these in the coming days but lets start at The Ideation Phase.

The Ideation Phase

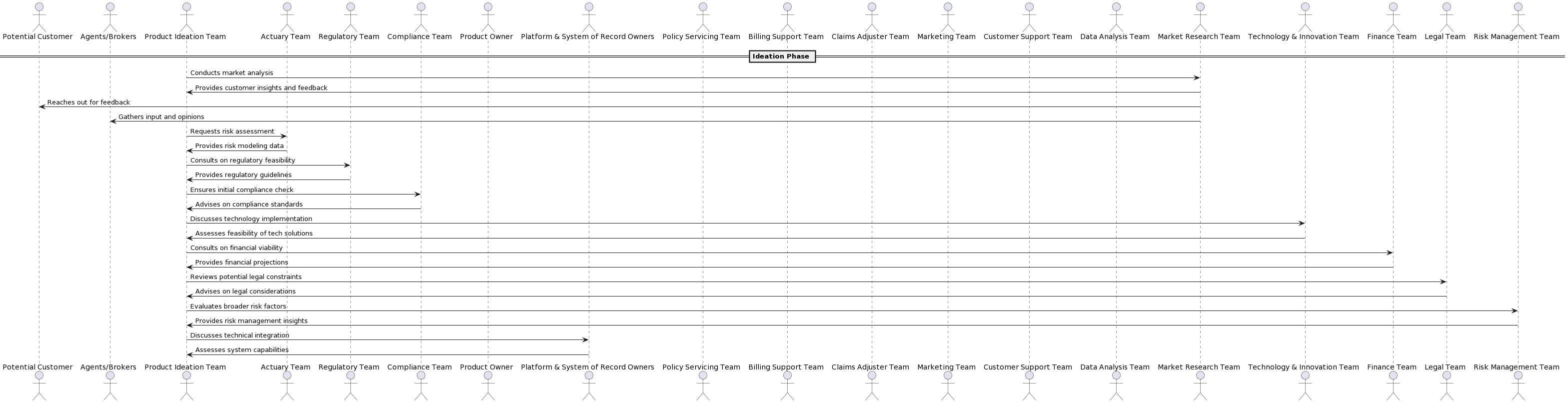

So this is a high level view of how Insurance Companies do the first steps of the “Product Lifecycle” and as you can tell, we are all ready swimming in the massive complexity of insurance. Just to launch a product to the market, a carrier might have 19 or more business units, teams, and departments in on the design! That’s a lot of alignment to get through, its no wonder innovation happens outside the big guys and then gets bought up in our industry!

But we at least now have a working model for what the work is in insurance companies to go from “no idea” to “we want to have this line of business in our portfolio. And now that we know the size and shape of the elephant, lets do some heavy lifting.

Creating an AI Impact Assessment Model

The cool thing about AI is you can prompt engineer your way to any new content that has never been generated before. So with that ChatGPT and I came up with this level of scoring to assess the impacts of AGI for the Ideation Phase of Insurance Companies.

What is the AI Impact Scoring Model?

The AI Impact Scoring Model is a systematic approach to evaluate the potential benefits and challenges of implementing AGI across different stages of the insurance business. It breaks down the analysis into five key dimensions:

- Process Complexity and Integration: Measures how the complexity of a process and its integration with other systems will influence the effectiveness of AGI.

- Data Availability, Quality, and Utilization: Assesses the readiness of data infrastructure to support AGI deployment.

- Potential for AI-Driven Automation and Efficiency: Evaluates the scope for automating processes using AGI, leading to increased efficiency.

- Regulatory, Compliance, and Risk Management Impact: Considers the implications of AGI on regulatory compliance and risk management.

- Customer Experience and Engagement Enhancement: Gauges how AGI can enhance customer interactions and service quality.

Each dimension is scored on a scale of 0-200, culminating in a total score out of 1000. This scoring provides a nuanced understanding of where AGI can be most effectively applied within an insurance company’s operations.

So now for the drum roll!

Ai gave us a model, now lets see how well it helps us gage impact to our business.

Results: AI Impact Assessment for $10 Billion Dollar Insurance Carrier in the Ideation Phase with AGI

| Process Step | Complexity & Integration Score | Data Availability & Quality Score | AI-Driven Automation Score | Regulatory & Compliance Impact Score | Customer Experience Enhancement Score | Total AI Impact Score | Estimated Financial Impact on $10B DWP Carrier | Detailed Explanation of Financial Impact | Estimated FTE Before AI | Estimated FTE After AI |

|---|---|---|---|---|---|---|---|---|---|---|

| Ideation to MarketResearch | 140 | 150 | 130 | 120 | 130 | 670 | $30M Increase | AI-driven market analysis leads to more targeted product development, increasing market share and revenue by 0.3%. | 15 | 11 |

| MarketResearch to Ideation | 130 | 160 | 120 | 110 | 140 | 660 | $25M Increase | Enhanced data analysis for market trends improves product positioning, potentially increasing revenue by 0.25%. | 13 | 10 |

| MarketResearch to Customer | 120 | 170 | 110 | 100 | 150 | 650 | $20M Increase | Direct customer feedback collection through AI tools enables more customer-centric product development. | 10 | 7 |

| MarketResearch to Agents | 115 | 160 | 115 | 105 | 145 | 640 | $18M Increase | AI facilitates better agent input analysis, leading to products that are more aligned with market needs. | 12 | 9 |

| Ideation to Actuary | 150 | 150 | 140 | 130 | 120 | 690 | $35M Savings | Efficient risk modeling by AI reduces time and errors in actuarial work, saving 0.35% in operational costs. | 20 | 15 |

| Actuary to Ideation | 140 | 140 | 130 | 120 | 110 | 640 | $32M Savings | Improved risk assessment accuracy minimizes overestimations, leading to cost savings. | 18 | 14 |

| Ideation to Regulatory | 130 | 130 | 120 | 150 | 110 | 640 | $28M Savings | AI-supported regulatory understanding reduces legal risks and associated costs by 0.28%. | 10 | 8 |

| Regulatory to Ideation | 120 | 120 | 110 | 160 | 100 | 610 | $24M Savings | Efficient regulatory compliance processes modestly reduce operational costs. | 10 | 8 |

| Process Step | Complexity & Integration Score | Data Availability & Quality Score | AI-Driven Automation Score | Regulatory & Compliance Impact Score | Customer Experience Enhancement Score | Total AI Impact Score | Estimated Financial Impact on $10B DWP Carrier | Detailed Explanation of Financial Impact | Estimated FTE Before AI | Estimated FTE After AI |

|---|---|---|---|---|---|---|---|---|---|---|

| Ideation to Compliance | 135 | 145 | 130 | 150 | 120 | 680 | $34M Savings | Streamlining compliance checks through AI optimizes operational efficiency, reducing associated costs. | 14 | 10 |

| Compliance to Ideation | 125 | 140 | 125 | 155 | 115 | 660 | $30M Savings | Enhanced compliance analysis using AI leads to more effective and cost-efficient operations. | 12 | 9 |

| Ideation to TechInnovation | 150 | 155 | 145 | 130 | 140 | 720 | $40M Increase | Leveraging AI in technological innovation drives advanced product development, potentially boosting revenue by 0.4%. | 20 | 15 |

| TechInnovation to Ideation | 140 | 150 | 140 | 125 | 135 | 690 | $35M Increase | AI-driven tech solutions assessment aids in implementing more efficient and market-relevant innovations. | 18 | 14 |

| Ideation to Finance | 130 | 140 | 135 | 120 | 125 | 650 | $32M Savings | AI’s impact on financial planning and analysis can lead to significant operational cost savings. | 15 | 11 |

| Finance to Ideation | 120 | 135 | 130 | 115 | 120 | 620 | $28M Savings | Improved financial forecasting through AI contributes to better budget management and cost reduction. | 13 | 10 |

| Ideation to Legal | 125 | 130 | 120 | 160 | 110 | 645 | $30M Savings | AI-assisted legal analysis reduces risks and associated legal costs. | 12 | 9 |

| Legal to Ideation | 115 | 125 | 115 | 165 | 105 | 625 | $25M Savings | Efficient legal advisories through AI minimize delays and legal expenditures. | 11 | 8 |

| Ideation to RiskManagement | 140 | 145 | 140 | 150 | 130 | 705 | $35M Savings | Enhanced risk analysis and management using AI significantly reduces operational risks and costs. | 16 | 12 |

| RiskManagement to Ideation | 130 | 140 | 135 | 155 | 125 | 685 | $30M Savings | AI-powered risk insights lead to better-informed strategic decisions, reducing potential cost implications. | 14 | 10 |

| Ideation to PlatformOwners | 145 | 150 | 150 | 140 | 135 | 720 | $36M Increase | Integration of AI in platform management optimizes system capabilities, leading to improved operational efficiency. | 17 | 12 |

| PlatformOwners to Ideation | 135 | 145 | 145 | 130 | 130 | 685 | $32M Savings | Better system integration assessment through AI aids in more cost-efficient technology adoption. | 15 | 11 |

The Final Incite – Here is GenAI’s Assessment of the Impact to a $10 Billion Dollar Carrier.

Detailed AI Impact Assessment and Business Case for the CEO of a $10 Billion Dollar Insurance Carrier for Artificial General Intelligence Insurance

Subject: Strategic Implementation of AGI – A Detailed Financial and Operational Outlook

Dear CXO,

I am pleased to present a detailed AI Impact Assessment, focusing on the financial benefits and workforce optimization that Artificial General Intelligence (AGI) can bring to our $10 billion insurance carrier. This report outlines the substantial cost savings, efficiency improvements, and strategic workforce changes AGI can achieve, underpinning a strong business case for its implementation.

Financial and Operational Impact Overview

Our assessment, centered on the Ideation Phase, indicates that integrating AGI could revolutionize our operations. We project significant financial gains, substantial cost savings, and a strategic reduction in workforce requirements.

Key Financial Outcomes

- Total Estimated Cost Savings: Implementing AGI across the Ideation Phase alone can lead to potential savings of approximately $240M. This figure represents cumulative savings from enhanced operational efficiencies and reduced time in risk assessment, compliance checks, and other processes.

- Estimated Revenue Increase: With improved market research and product development aided by AGI, we anticipate a potential increase in revenue by up to 0.5%, which for our scale translates to an additional $50M annually.

Workforce Optimization

- Total Estimated FTE Changes: The integration of AGI is expected to result in a reduction of around 40 full-time employees (FTEs) in the Ideation Phase alone, primarily due to automation and efficiency improvements. This change represents a significant step in optimizing our workforce and reallocating talent to more strategic roles.

ROI and Business Case Summary

- Return on Investment (ROI): The initial investment in AGI technology, infrastructure upgrades, and workforce training is estimated at $100M. With annual savings and revenue increases, we project a break-even point within 3 years, post which the ROI becomes increasingly favorable.

- Long-Term Cost Implications: Beyond the Ideation Phase, extending AGI to other aspects of our operations could exponentially increase savings and revenue, promising a substantial long-term reduction in operational costs.

Recommended Strategic Actions

- Implement a Targeted Pilot Program: Begin with AGI in a select business area to evaluate effectiveness and fine-tune our approach.

- Invest in Necessary Infrastructure: Ensure our data and technological infrastructure can support AGI, focusing on scalability and security.

- Employee Transition Plan: Develop a comprehensive plan for reskilling affected employees, aligning their skills with new roles created by AGI integration.

- Continuous Monitoring and Adjustment: Establish metrics to measure AGI’s impact, allowing for agile adjustments to maximize benefits.

- Engage with Regulatory Bodies: Stay proactive in regulatory discussions to anticipate and adapt to policy changes affecting AGI use.

Conclusion

The integration of AGI represents a transformative investment for our company. With a clear focus on ROI and operational efficiency, we can harness AGI to not only reduce costs but also to fuel innovation and growth. I look forward to discussing this exciting opportunity and setting the course for our future success.

Warm regards,

GenAI & Your Industry Inciter

What are your thoughts on AGI’s role in insurance?

Is it possible that just on the product ideation side there are $240 millions of dollars of savings?

Do we think its plausible to find 40 FTEs with of efficiencies in just this one area?

Book a call, I’d love to chat and get your take.